You have selected the assets you would like to invest in, after spending hours analyzing data and now it is time to get into the market. Does it make sense to invest your capital using the same amount of money for each stock? Well, simply the answer is no.

Modern Portfolio Theory

Modern Portfolio Theory (MPT) by Harry Markowitz advocates diversification to manage risk and optimize returns. It suggests allocating your capital, based on risk-return profiles and correlation, aiming to reduce overall portfolio risk while maximizing potential returns. Markowitz was awarded the Nobel Prize in Economics in 1990 for this theory, which has since become a cornerstone of investment strategy, emphasizing diversification and risk management to optimize portfolio returns.

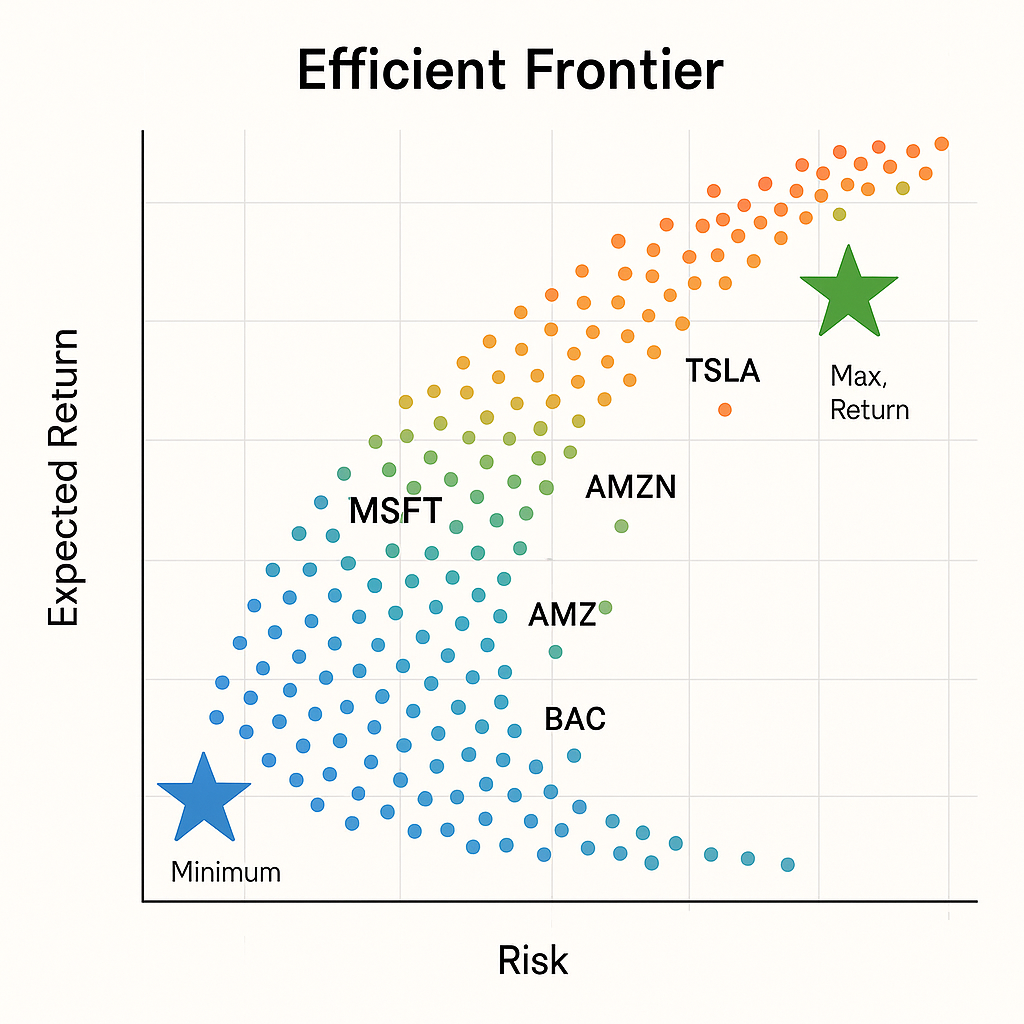

Efficient Frontier

A key tool in Modern Portfolio Theory is the Efficient Frontier, which illustrates the trade-off between risk and return in investment portfolios. It represents the set of optimal portfolios that offer the highest expected return for a given level of risk, or the lowest risk for a given level of expected return. Below is a nice video from Investopedia — with a small typo in the title from their end… 😉

https://cdn.embedly.com/widgets/media.html?src=https%3A%2F%2Fwww.youtube.com%2Fembed%2FPiXrLGMZr1g%3Ffeature%3Doembed&display_name=YouTube&url=https%3A%2F%2Fwww.youtube.com%2Fwatch%3Fv%3DPiXrLGMZr1g&image=https%3A%2F%2Fi.ytimg.com%2Fvi%2FPiXrLGMZr1g%2Fhqdefault.jpg&key=a19fcc184b9711e1b4764040d3dc5c07&type=text%2Fhtml&schema=youtube

Let’s code!

Enough with theory. Let’s see how you can get your optimal portfolio with Python.

As usual, let’s do our imports

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

from matplotlib import style

import yfinance as yf

import datetime as dtThen we should set up our parameters. Most important is the stocks that we want to invest in. In our example, we will select Microsoft (MSFT), Amazon (AMZN), Tesla (TSLA), Banc of America (BAC), and Coca-Cola (KO). I have selected from various industries and risk profiles, so we have as many as possible not highly correlated stocks.

What would have been an investment article if it did not have the guessing part? That is what we expect the return to be for each stock. For that, I used Yahoo Finance and the estimated price of 1y that they provide and divided it by the current price as 1 — (1y target est / current price). Unfortunately, I couldn’t find in yfinance python package how to get this automatically. Feel free to comment on the article if you know another automated way (sharing is caring!).

tickers = ['MSFT', 'AMZN', 'TSLA', 'BAC', 'KO']

tickers_estimate_return = [0.1, 0.18, 0.22, 0.08, 0.11]

test_number_of_portfolios = 1000

risk_free = 0.019

timeframe = '1d'

days_of_simulation = 365

working_days_of_period = 252

end = dt.datetime.now()

start = end - dt.timedelta(days=days_of_simulation)

print(f'''Getting data from {start.strftime('%Y-%m-%d')} to {end.strftime('%Y-%m-%d')}''')Risk-free rate is the return that an investor will gain, without any risk. The usual practice is to subtract the inflation from the US Treasury Bond. At the time of writing the article the 1 year US bond was 5.05% and the US inflation was 3.15%. This means that the risk free rate is 1.90%

Then we can get the adjusted prices of those stocks using yfinance and convert them to the daily return.

prices = yf.download(tickers, period=timeframe, start=start, end=end)['Adj Close'].pct_change()

prices.columns.name = None

prices.dropna(inplace=True)

prices = prices[tickers] #to ensure we got them in the proper order

prices.head(5)

+----------+---------+---------+---------+---------+---------+

| |MSFT |AMZN |TSLA |BAC |CAT |

|Date | | | | | |

+----------+---------+---------+---------+---------+---------+

|2023-03-21|0.005694 |0.029680 |0.078199 |0.030270 |0.020925 |

|2023-03-22|-0.005442|-0.018984|-0.032544|-0.033228|-0.022097|

|2023-03-23|0.019722 |0.000101 |0.005598 |-0.024240|-0.002319|

|2023-03-24|0.010480 |-0.005876|-0.009416|0.006303 |-0.011074|

|2023-03-27|-0.014934|-0.000917|0.007353 |0.049742 |0.004562 |

+----------+---------+---------+---------+---------+---------+Now we should create a function that will calculate the annual estimated return, risk, and shape ratio for a specific weight and risk-free ratio.

def calc_portfolio_ratios(prices, weights, estimated_returns,risk_free):

# estimated period returns

estimated_period_return = np.sum(estimated_returns * weights)

# risk (standard deviation) of portfolio

cov_matrix = prices.cov() * working_days_of_period

variance = weights.T.dot(cov_matrix).dot(weights)

period_risk = np.sqrt(variance)

# sharpe ratio

period_sharpe_ratio = (estimated_period_return - risk_free) / period_risk

return estimated_period_return, period_risk, period_sharpe_ratioUsing a Monte Carlo simulation, we will create 1000 random weighted portfolios and store the results of the above function in lists.

portfolio_rtn = []

portfolio_risk = []

portfolio_sharpe = []

portfolio_weights = []

# run the simulations and add the results to lists

for portfolio in range(test_number_of_portfolios):

# create a random set of weights and sum them up to 1

weights = np.random.random(len(tickers))

weights /= np.sum(weights)

portfolio_weights.append(weights)

#calc the return, risk and sharpe

annual_return, annual_risk, sharpe_ratio = calc_portfolio_ratios(prices, weights, tickers_estimate_return, risk_free)

portfolio_rtn.append(annual_return)

portfolio_risk.append(annual_risk)

portfolio_sharpe.append(sharpe_ratio)

For a better understanding of the results, we can add to the simulations portfolios that will consist only of one stock.

for i, t in enumerate(tickers):

weights = np.zeros(len(tickers))

weights[i] = 1

portfolio_weights.append(weights)

annual_return, annual_risk, sharpe_ratio = calc_portfolio_ratios(prices, weights, tickers_estimate_return, risk_free)

portfolio_rtn.append(annual_return)

portfolio_risk.append(annual_risk)

portfolio_sharpe.append(sharpe_ratio)Following that, we will convert the simulations into a pandas dataframe

portfolio_risk = np.array(portfolio_risk)

portfolio_sharpe = np.array(portfolio_sharpe)

portfolio_return = np.array(portfolio_rtn)

portfolio_metrics = [portfolio_rtn, portfolio_risk, portfolio_sharpe]

df_portfolio_metrics = pd.DataFrame(portfolio_metrics).T

df_portfolio_metrics.columns=['Estimated Returns', 'Risk', 'Sharpe']

df_weights = pd.DataFrame(portfolio_weights)

df_weights.columns = tickers

df_simulations = df_portfolio_metrics.join(df_weights)

df_simulations.head(5)

This will get us the results:

+-+-----------------+--------+--------+--------+--------+--------+--------+--------+

| |Estimated Returns|Risk |Sharpe |MSFT |AMZN |TSLA |BAC |KO |

+-+-----------------+--------+--------+--------+--------+--------+--------+--------+

|0|0.129994 |0.180888|0.613605|0.218611|0.121753|0.204237|0.293634|0.161765|

|1|0.104374 |0.173083|0.493254|0.485706|0.064478|0.057908|0.388411|0.003496|

|2|0.122598 |0.204623|0.506286|0.343321|0.027902|0.233360|0.386399|0.009019|

|3|0.130219 |0.166566|0.667718|0.258375|0.294587|0.074261|0.199563|0.173213|

|4|0.136895 |0.215162|0.547935|0.168959|0.059422|0.311878|0.329393|0.130347|

+-+-----------------+--------+--------+--------+--------+--------+--------+--------+For example, the first portfolio to be simulated, has a return of 13%, with a risk of 0.18 and a shape ratio of 0.61 with Microsoft being 22% of our investment, Amazon 12%, Tesla 20%, Banc of America 29% and Coca-Cola 16%.

For a better visibility, we can create a separate dataframe with the simulations where we have the maximum return, minimum risk, maximum Sharpe ratio, and individual stocks. This can be done with the below piece of code:

#keep the index of the min risk, max return, max sharpe and individual stocks to be used in plot

min_risk_idx = df_simulations['Risk'].idxmin()

max_return_idx = df_simulations['Returns'].idxmax()

max_sharpe_idx = df_simulations['Sharpe'].idxmax()

tickers_idx = []

for i, t in enumerate(tickers):

tickers_idx.append(df_simulations[t].idxmax())

#create a dataframe for better visibility of the results

df_results = df_simulations.iloc[[min_risk_idx, max_return_idx, max_sharpe_idx] + tickers_idx]

df_results.insert(0, 'Description', ['Min Risk', 'Max Return', 'Max Sharpe'] + tickers)

df_results

The results are:

+----+-----------+-----------+--------+--------+--------+--------+--------+--------+--------+

| |Description|Est.Returns|Risk |Sharpe |MSFT |AMZN |TSLA |BAC |KO |

+----+-----------+-----------+--------+--------+--------+--------+--------+--------+--------+

|361 |Min Risk |0.113252 |0.116741|0.807366|0.101568|0.033010|0.060796|0.157675|0.646951|

|1002|Max Return |0.220000 |0.483333|0.415862|0.000000|0.000000|1.000000|0.000000|0.000000|

|607 |Max Sharpe |0.129604 |0.125092|0.884186|0.054415|0.215397|0.048036|0.007103|0.675050|

|1000|MSFT |0.100000 |0.223922|0.361733|1.000000|0.000000|0.000000|0.000000|0.000000|

|1001|AMZN |0.180000 |0.302707|0.531868|0.000000|1.000000|0.000000|0.000000|0.000000|

|1002|TSLA |0.220000 |0.483333|0.415862|0.000000|0.000000|1.000000|0.000000|0.000000|

|1003|BAC |0.080000 |0.252760|0.241336|0.000000|0.000000|0.000000|1.000000|0.000000|

|1004|KO |0.110000 |0.128714|0.706994|0.000000|0.000000|0.000000|0.000000|1.000000|

+----+-----------+-----------+--------+--------+--------+--------+--------+--------+--------+Also to have a visual representation of all the simulations, we can run the below code to get a scatter plot

plt.figure(figsize=(10, 6))

plt.scatter('Risk', 'Returns', c='Sharpe', cmap='viridis', edgecolors='k', data=df_simulations, alpha=0.7, s=50)

plt.colorbar(label = "Sharpe Ratio")

plt.xlabel('Risk')

plt.ylabel('Expected Returns')

plt.title('Portfolio Optimization Efficient Frontier')

plt.suptitle(f'From {start.strftime("%Y-%m-%d")} to {end.strftime("%Y-%m-%d")}\nNumber of portfolios = {test_number_of_portfolios}', fontsize=8)

#add a star to Max Sharpe

plt.scatter(df_simulations.iloc[max_sharpe_idx]['Risk'], df_simulations.iloc[max_sharpe_idx]['Returns'], marker='*', s=500, c='red')

#add a star to Max Return

plt.scatter(df_simulations.iloc[max_return_idx]['Risk'], df_simulations.iloc[max_return_idx]['Returns'], marker='*', s=500, c='green')

#add a star to Min Risk

plt.scatter(df_simulations.iloc[min_risk_idx]['Risk'], df_simulations.iloc[min_risk_idx]['Returns'], marker='*', s=500, c='blue')

#add the individual stocks

for i, t in enumerate(tickers):

plt.scatter(df_simulations.iloc[tickers_idx[i]]['Risk'], df_simulations.iloc[tickers_idx[i]]['Returns'], marker='o', s=500, c='white')

plt.scatter(df_simulations.iloc[tickers_idx[i]]['Risk'], df_simulations.iloc[tickers_idx[i]]['Returns'], marker=f'${t}$', s=500, c='red')

plt.show()

At this point, it is just a matter of your risk appetite to determine how you will allocate your funds to each stock:

- Minimum Risk (blue star): Estimated Cumulative Return will be 11% (MSFT 18%, AMZN 6%, TSLA 4%, BAC 13%, and KO 57%)

- Maximum Sharpe Ratio (red star): Estimated cumulative return will be 13% (MSFT 4%, AMZN 24%, TSLA 5%, BAC 4%, and KO 61%)

- Anywhere on the yellow part were the largest values of Sharpe Ratio are (yellow dots)

If you question why not the maximum return: well apparently the answer would be 100% of the stock that has the maximum return projected (TSLA) but I hope we agreed before that this is not what we are looking for…

Some conclusions

Based on the above lets try to understand some observations

Why Coca-Cola is the most to be invested: It has the lowest risk of all. In fact you will see in the plot that is very close to both blue and red stars

Then why not to invest 100% in Coca-cola: That is the whole point of this method. With diversification, we achieve with less risk , more return.

Why not more to Tesla since clearly it has the biggest expected return of all: Well, it also has the biggest risk of all.

You can find the above code at GiHub